Get the free certificate fiduciary authority

Show details

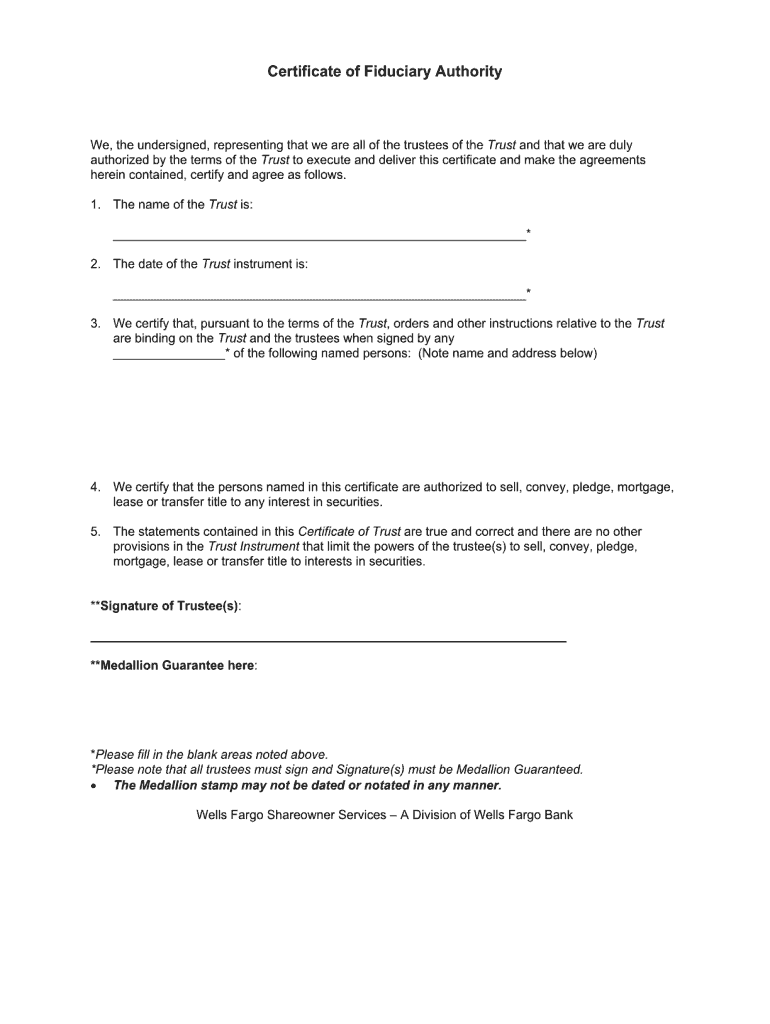

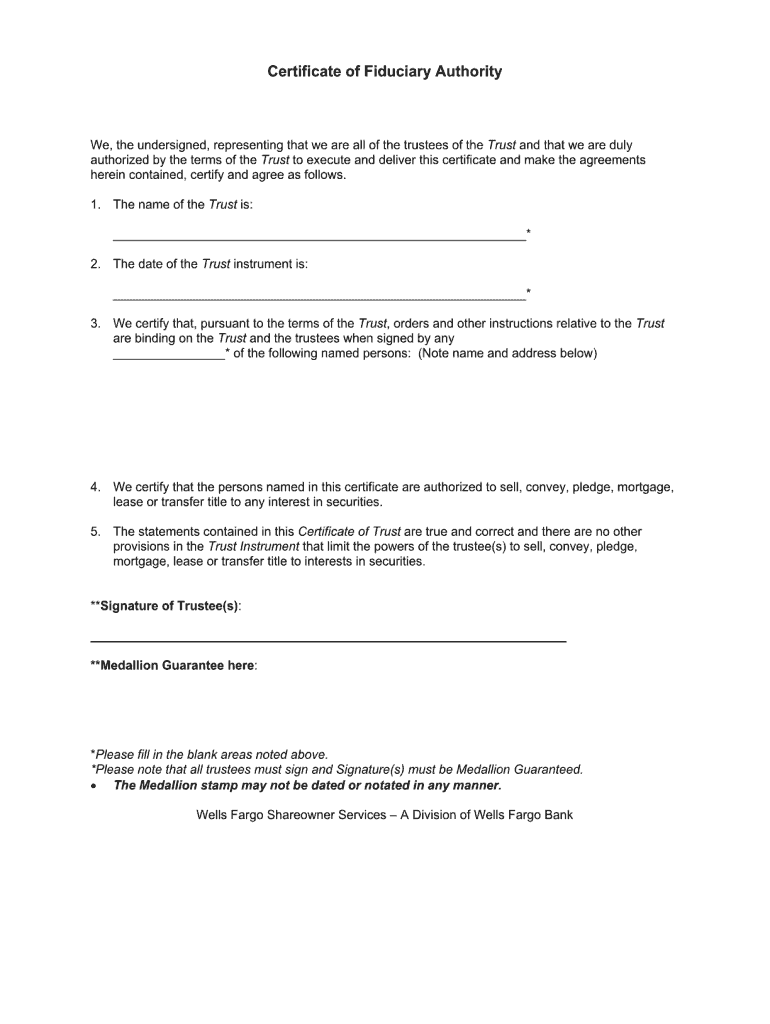

Certificate of Fiduciary Authority We, the undersigned, representing that we are all the trustees of the Trust and that we are duly authorized by the terms of the Trust to execute and deliver this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign certification trustee wells form

Edit your certificate of fiduciary authority form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certification trustee wells form via URL. You can also download, print, or export forms to your preferred cloud storage service.

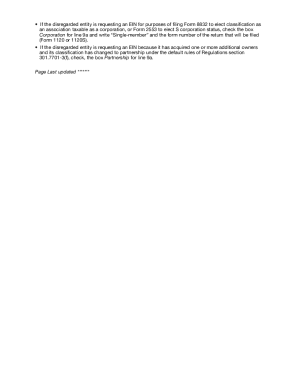

Editing certificate of fiduciary authority online

Follow the steps down below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wells fiduciary authority form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

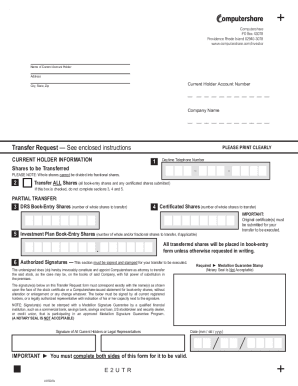

How to fill out wells fargo certificate fiduciary form

How to fill out Wells Fargo Bank Certificate of Fiduciary Authority

01

Obtain the Wells Fargo Bank Certificate of Fiduciary Authority form from a Wells Fargo branch or their website.

02

Fill in your name and title as the fiduciary (executor, administrator, trustee, etc.).

03

Provide the name of the entity (like an estate or trust) for which you are acting as a fiduciary.

04

Include the date when the fiduciary authority is effective.

05

Attach any supporting documentation required to verify your authority (such as a will or trust document).

06

Sign the form, affirming that the information is true and accurate.

07

Submit the completed form to the appropriate Wells Fargo branch or agent.

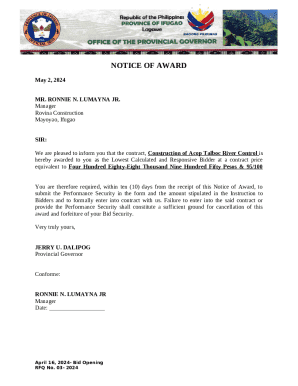

Who needs Wells Fargo Bank Certificate of Fiduciary Authority?

01

Individuals acting as executors or administrators of an estate.

02

Trustees managing trust assets.

03

Guardians appointed to manage the affairs of minor or dependent individuals.

04

Personal representatives designated in legal documents to handle financial matters.

Video instructions and help with filling out and completing certificate fiduciary authority

Instructions and Help about wells fargo fiduciary authority

Fill

fargo certificate fiduciary form

: Try Risk Free

People Also Ask about mium certificate of fiduciary authority form

Who is fiduciary of trust?

An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust.

Who is the fiduciary of an irrevocable trust?

The trustee is the person responsible for the management of a trust. He or she has a duty of loyalty, known as a fiduciary responsibility, for the beneficiaries of the trust.

What does it mean to be fiduciary of the trust?

A trustee is a fiduciary, which means that the trustee is held to a high standard of care and may be expected to pay more attention to the trust's investment and management than he/she generally would pay to his/her own personal accounts or assets.

Who holds fiduciary responsibility?

Fiduciary responsibility refers to the obligation that one party has in relationship with another one to act entirely on the other party's behalf and best interest. It is considered to be the standard of the highest care. The individual who has the responsibility of being a fiduciary is referred to as the fiduciary.

What is the difference between a trustee and a fiduciary on a trust?

The Fiduciary of a Trust is the Trustee, who is tasked with overseeing the management of property and assets within the Trust. Simply put, a Fiduciary is someone who acts on behalf of another person, often in a legal or financial capacity.

What are the powers of a fiduciary?

Fiduciary or trust powers allow a bank to act in a fiduciary capacity ing to applicable laws and regulations. The OCC views the exercise of fiduciary powers primarily as a management decision of the bank, absent supervisory or legal concerns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certificate fiduciary authority?

Certificate fiduciary authority refers to a legal document that grants an individual or organization the power to act as a fiduciary on behalf of another party. A fiduciary is a person or entity entrusted with the responsibility to manage someone else's assets, finances, or investments in a trustworthy and ethically responsible manner. By obtaining a certificate fiduciary authority, the individual or organization is legally recognized as having the knowledge, skills, and qualifications necessary to fulfill their fiduciary duties. This certification helps provide assurance to clients or beneficiaries that the fiduciary will act in their best interests and adhere to specific legal and ethical standards.

Who is required to file certificate fiduciary authority?

Individuals who are appointed as fiduciaries, such as executors, administrators, trustees, or guardians, are typically required to file a Certificate of Fiduciary Authority with the relevant authority. The specific requirements may vary depending on the jurisdiction and the type of fiduciary role. It is advisable to consult with a legal professional or the appropriate government agency to determine the filing requirements in a particular situation.

How to fill out certificate fiduciary authority?

To fill out a Certificate of Fiduciary Authority, follow these steps:

1. Obtain the form: Depending on your jurisdiction and the purpose of the form, you may need to obtain it from a specific government agency, court, or attorney. Ensure you have the correct form for your specific situation.

2. Read the instructions: Carefully read through the instructions provided with the form. Familiarize yourself with the requirements, guidelines, and any supporting documents you may need to gather.

3. Provide personal information: Begin by providing your personal information, including your full legal name, address, contact information, and any identification numbers required, such as your Social Security number or tax identification number.

4. Appoint a fiduciary: Indicate the name and contact information of the person or entity you are appointing as your fiduciary. This could be an individual, a company, or an organization.

5. Describe the fiduciary's authority: Clearly state the authority you are granting to the fiduciary. Be specific and detailed, ensuring there is no ambiguity in understanding the extent of their powers and responsibilities.

6. Include any limitations or conditions: If you want to impose any limitations or conditions on the fiduciary's authority, clearly state them in this section. This could include instructions, requirements, or restrictions they must follow while executing their fiduciary duties.

7. Notarization: Depending on the jurisdiction and the type of authority being granted, you may need to sign the certificate in the presence of a notary public. Follow the notarization instructions if required.

8. Attach supporting documents: Check if any supporting documents are required to accompany the certificate. This could include copies of identification, letters of consent, or other legal documents. Ensure you attach all necessary paperwork before submitting the form.

9. Review and double-check: Before submitting the certificate, carefully review the entire form for accuracy and completeness. Ensure all information is provided correctly and that you have complied with all instructions and requirements.

10. Submit the form: Once you are satisfied with the accuracy of the form, follow the provided instructions for submitting it. This may involve mailing it to the appropriate address, submitting it electronically, or personally delivering it to the relevant agency or court.

Remember, the steps and requirements for filling out a Certificate of Fiduciary Authority may vary depending on your jurisdiction and the specific purpose of the certificate. It is always advisable to consult an attorney or legal expert if you have any doubts or concerns.

What is the purpose of certificate fiduciary authority?

There is no specific term or concept called "certificate fiduciary authority". However, there is a term called "certificate of fiduciary authority" in the context of estate planning.

A certificate of fiduciary authority is a legal document issued by a court or government agency that grants a person or entity the authority to act as a fiduciary on behalf of an estate, trust, or conservatorship.

The purpose of a certificate of fiduciary authority is to provide official recognition and confirmation that the designated individual or organization has the legal power and responsibility to manage the assets, make financial decisions, distribute property, and act in the best interests of the beneficiaries. It serves as evidence of the fiduciary's legitimate authority and can be presented when carrying out their duties, such as managing investments, settling debts, or distributing assets according to the terms of a will or trust.

Overall, the purpose of a certificate of fiduciary authority is to ensure proper administration and oversight of an estate or trust, safeguard the interests of beneficiaries, and provide a legal framework for the fiduciary to carry out their duties effectively.

What information must be reported on certificate fiduciary authority?

When reporting on a certificate of fiduciary authority, the following information must generally be included:

1. Fiduciary's Name: The full legal name of the individual or organization that has been granted fiduciary authority.

2. Fiduciary's Address: The mailing address or physical location of the fiduciary. This information is important for correspondence and legal purposes.

3. Fiduciary's Contact Details: Any contact information such as phone number, email address, or fax number that allows for easy communication with the fiduciary.

4. Authority Granted: A clear description of the specific authority or powers granted to the fiduciary. This may include details of managing assets, making financial decisions, or handling legal matters on behalf of others.

5. Effective Date: The date from which the fiduciary authority is considered valid and enforceable. This is the starting point when the fiduciary can legally act on behalf of others.

6. Expiration Date (if applicable): If the fiduciary authority has a specified duration, the expiration date should be mentioned. This is relevant when a fiduciary's authority is time-limited, such as in a specific contractual arrangement.

7. Jurisdiction: The particular jurisdiction or governing law under which the fiduciary authority is granted. This helps establish the legal framework within which the fiduciary operates.

8. Governing Document: Reference to the legal document or instrument granting the fiduciary authority, such as a trust agreement, power of attorney, or will. This document clarifies the nature and extent of the fiduciary's responsibilities.

9. Limitations or Restrictions: Any specific limitations or restrictions placed on the fiduciary's authority should be indicated. For example, the fiduciary may be restricted from making certain types of investments or may require court approval for specific actions.

10. Reporting Obligations: Details of any reporting requirements that the fiduciary must fulfill. This may include regular financial reporting, providing account statements to beneficiaries, or filing tax returns on behalf of the trust or estate.

It's important to note that the specific requirements for reporting on a certificate of fiduciary authority can vary depending on the jurisdiction or the type of fiduciary relationship. Therefore, when preparing such a certificate, it is best to consult the applicable laws and regulations to ensure compliance.

How can I get Wells Fargo Bank Certificate of Fiduciary Authority?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Wells Fargo Bank Certificate of Fiduciary Authority in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the Wells Fargo Bank Certificate of Fiduciary Authority in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your Wells Fargo Bank Certificate of Fiduciary Authority directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit Wells Fargo Bank Certificate of Fiduciary Authority straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing Wells Fargo Bank Certificate of Fiduciary Authority.

What is Wells Fargo Bank Certificate of Fiduciary Authority?

The Wells Fargo Bank Certificate of Fiduciary Authority is a document that certifies the authority of an individual or entity to act on behalf of a trust, estate, or other fiduciary relationships when dealing with the bank.

Who is required to file Wells Fargo Bank Certificate of Fiduciary Authority?

Individuals or entities who have been appointed as fiduciaries, such as trustees, executors, or agents under a power of attorney, are required to file the Wells Fargo Bank Certificate of Fiduciary Authority.

How to fill out Wells Fargo Bank Certificate of Fiduciary Authority?

To fill out the Wells Fargo Bank Certificate of Fiduciary Authority, you must provide details such as your name, the name of the trust or estate, the date of your appointment, and any relevant identification details. It is important to follow the instructions provided on the form.

What is the purpose of Wells Fargo Bank Certificate of Fiduciary Authority?

The purpose of the Wells Fargo Bank Certificate of Fiduciary Authority is to establish and confirm the authority of the fiduciary to manage accounts or assets related to a trust or estate on behalf of the beneficiaries and to ensure safe and proper handling of financial matters.

What information must be reported on Wells Fargo Bank Certificate of Fiduciary Authority?

The information that must be reported on the Wells Fargo Bank Certificate of Fiduciary Authority includes the fiduciary's name, contact information, the capacity in which they are acting, details about the trust or estate, and supporting documentation to verify their appointment and authority.

Fill out your Wells Fargo Bank Certificate of Fiduciary Authority online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Bank Certificate Of Fiduciary Authority is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.